Five steps to get started with investing

You don't need to be an investment guru to invest in the stock market. You don't need a boatload of money. How to get started with investing?

-

Open a Demat account with a discount stockbroker. Which can be opened in a few clicks online. Just think of a Demat account as a bank account for your investments.

-

How much money should I invest? Allocate an amount of money that you are OKAY with losing every month. It could be as small as Rs. 2000 / 30 dollars.

-

Pick a top-performing Large cap or Blue chip mutual fund - Should be at least five years old. - You can Google it. Start a Monthly SIP with the amount you selected in 2. SIP = investing money at regular intervals; in this, e.g. monthly

-

Get rid of the get rich quick mindset. Think of investment in the long term. Remember you're okay with losing the amount you selected in 2. The actual returns become exponential after 20 years.

-

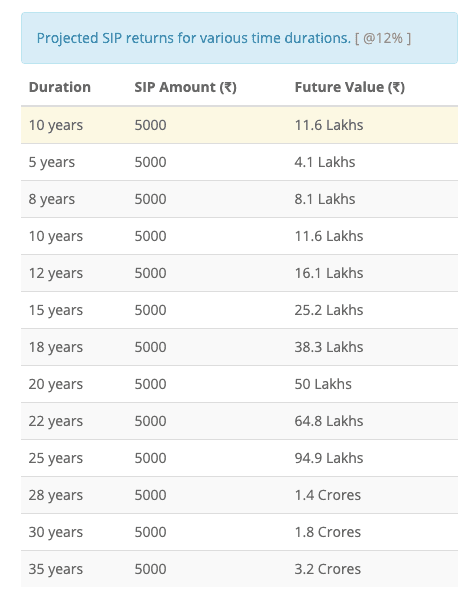

A Rough Calculation investing Rs 5000/$80 per month with a rate of return of mutual fund - 12 % (modest). Let us check the return of investment in:

- 10 years - 12 Lakh ( investments - 6L)

- 20 years - 50 Lakh (investments 12 L)

- 25 yrs - 95 lakh ( investments 15L)

- 30 yrs - 1.77 cr ( investments 18L)

All with the money you don't even care about.

Money not invested is money wasted

Benefits of SIP:

- You don't need to think or focus on timing the market.

- The amount is invested monthly and can be done weekly basis too.

- It's very flexible - you can start/update/cancel your SIP anytime.

- Most of the funds start as low as Rs. 500 per month.

Checkout

With an SIP, you can invest a fixed amount of money at regular intervals (such as monthly) rather than investing a lump sum all at once. This can be a convenient and effective way to invest, especially for those who may not have a large amount of money to invest upfront.

If you're interested in starting an SIP, SIP Calculator features a new SIP calculator tool that can help you determine how much you need to invest and how long it will take to reach your financial goals. Simply enter your desired investment amount and time frame, and the calculator will do the rest.

Note: Image source

If you learned something from this article, please share it with your friends.

You may also follow me on LinkedIn and X

💌 If you’d like to receive more coding tips and tricks in your inbox, you can sign up for the newsletter here.

Discussions